We are an energetic bunch of technology geeks and finance experts, passionate about providing the best platform to help you and your family in attaining financial peace. In a nutshell we help you to “Protect Your Hard Earned Wealth”.

In India over Rs. 82,000 crores are lying unclaimed in public and private financial institutions (Source - The Economic Times July 6, 2021 Edition). Imagine the number of dependents who are unable to claim their rightful inheritance.

The concept emerged after decades of serving Indian families while advising them for investments. What did we observe that an earning member (i.e. investor) of the family runs around, in his lifetime to earn for the family and builds assets for them. But irony is that, family members are many times even not aware of what s/he has been building / investing in. Result – When the earning member is no more then families face a lot financial issues and sometimes they unable to manage day to day expenses too.

Every

33 seconds

there is a death due to heart attack

Every

45 seconds

there is one death due to cancer

Every

04 Minutes

there is a death due to road accident

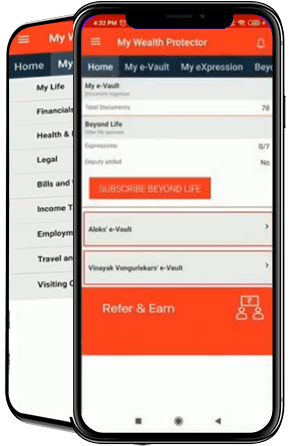

Download "My Wealth Protector Mobile app

Create Account

Update profile Details

Now relax and let us take care of your investment details

Add Deputy

(Verify Contact Details of Deputy)Share folders to added Deputy

Login and View Investment by Verified Deputy

Add up to 18 types of investments

Upload Investment file if any

Select visibility to verified Deputy

We regularly remind via SMS & Email to Member and added Deputy regardings status of account at My Wealth Protector.

In case of some accident of registered user, the deputy can share the Health Insurance policy details with required authorities as our service provides the facility where the user can share documents viewing rights with Deputy who is nothing but a family member only

Our mobile app is structured in such a way that now user, no need to worry about accessing any document be it personal document like PAN CARD, Adhaar card etc of self or family or any other document which are important to live smooth life like Bills & Warranty cards or even accessing HEALTH RECORDS of self or family member.

In a nutshell our service which helps an earning member in proactively updating the family about investments, insurances and other assets and a lot more

“My Wealth Protector”

end up keeping their partner in the dark about the investments made. Thus a majority of Rs. 64,000 crores lie unclaimed in public and private financial institutions.

reported having financial plan for unexpected events.Inability to deal with these events can be devastating for widows and their children.

and children have been deprived of their rightful inheritamces due to improper financial planning and unclear wills.

Dependents of deceased earning member to assist them in gaining ownership of all the financial assets left behind by deceased earning member

is an Online Subscription Platform

Mobile app and call center support

We also help the earning member organize his/her financial documents and investments. Our secure e-locker helps him/her store and access these documents 24X7.

Peace is the

Key Solution

Service which helps an earning member in proactively updating the family about investments, insurances and other assets

Earning members, My Wealth Protetor guides the widows in claiming all the investment and insurance.

Give peace of mind to the earning member when alive and give financial peace to the widow and dependents.

Features |

My Life Organizer

Free plan |

Beyond Life Peace

Paid plan |

|---|---|---|

|

Digitize by Scanning and EDIT, single & multiple documents and upload |

|

|

|

"Organized Folder Structure" for smooth upload and access anywhere anytime |

|

|

|

Search Documents and Images by typing |

|

|

|

Share files by email, whatsapp, FB or any app of your choice |

|

|

|

Integration with Digilocker for easy movements of documents to and from Digilocker |

|

|

|

Never Lose Originals Now: Ensure to Record location of Originals while uploading documents |

|

|

|

Voice typing while storing documents |

|

|

|

Two factor access (OTP) security |

|

|

|

256 Bit SSL encryption while data travel from device to servers |

|

|

|

High level encryption while storing data at servers |

|

|

|

Refer friends and earn extra facilities |

|

|

|

Assign Deputy (Nominee) - upto 2 Deputies |

|

|

|

Viewing rights with Deputies or CA as per user choice - Folder Level |

|

|

|

Upload wish list video, Audio and Text messages for your loved ones |

|

|

|

Assigning a dedicated service manager for the Family of Deceased User |

|

|

|

Printing of all information & documents and then segregating & giving them shape |

|

|

|

Attaching customized processes of getting ownership claim for each financial asset and then putting them in specially colour coded envelops |

|

|

|

Deputy can call an exclusively assigned counsellor on his mobile at call center for any help in getting ownership claim of financial assets |

|

|

|

Handing over the kit to deputy which contains information, investments and assets with all the processes and claim forms for getting ownership of financial assets |

|

|

|

Handing over wish list video, audio and letters to deputy |

|

|

Who is a deputy in My Wealth Protector Beyond Life (BL) Service?

What is My Wealth Protector Beyond Life (BL) Service?

Do I need a legal advisor if I use My Wealth Protector Beyond Life (BL) Service?

What is free and What is paid in My Wealth Protector Beyond Life (BL) Service?

How is My Wealth Protector Beyond Life (BL) Service different from an elocker?

Who needs My Wealth Protector Beyond Life (BL) Service ?

Will My Wealth Protector Beyond Life (BL) Service help me settle my claims?

How does the deputy connect with My Wealth Protector support team in case something happens to the client?

On which email id does the deputy need to send an email?

It seems like a lot of work to complete the My Wealth Protector Beyond Life (BL) Service . Is it worth doing only one or two parts?

What if I do not appoint a deputy?

Will my family get support of ‘My Wealth Protector’ to transfer the assets in case assets are in the name of HUF, POA, Trusts, Partnership firms?

What if my family members don’t want to avail the service of ‘My Wealth Protector Beyond Life (BL) Service ’ in case I am not there?

What if I don’t want to avail services of ‘My Wealth Protector Beyond Life (BL) Service ’?

I have done nomination and informed my family members. Do I still need to use the My Wealth Protector Beyond Life (BL) Service ? Isn’t this enough?

Is it safe & secure to use My Wealth Protector eVault to store my personal documents?